By Lucy Saddleton, Managing Editor, ADB Insights

Artificial intelligence is transforming businesses across industries, opening up new opportunities for efficiency, and fundamentally changing the way we work. The legal profession is no exception – undergoing an unprecedented transformation as AI platforms streamline legal work processes and enhance workflows.

Attendees at the Legal Innovation Forum’s recent webinar on Understanding AI discovered through expert discussions and live demonstrations how the latest AI tools can benefit their practice, how they can be applied – and potential risks to watch out for.

“AI is bigger than the internet, bigger than email, and bigger than the web. It is the most transformational technology that we have seen in our lifetime, and indeed, many lifetimes. It’s not an overstatement to describe it as a type of industrial revolution,” said Andrew Terrett, founder and CEO at Toronto-based Andrew Terrett Consulting Ltd.

In contrast to other forms of technology used in legal practice, AI can be used in many different ways. Over the next few years, we will see significant opportunities around operational enhancements, Terrett predicts.

Terrett described some of the different types of Large Language Models being used in legal services, including publicly accessible LLMs (ChatGPT, Anthropic, Perplexity, Gemini); industry tailored LLMs (Harvey, CoCounsel, vLex); and the more expensive customized/fully integrated LLMs (including Open Source, Azure Cognitive Services)

While large law firms are predominantly still at an an experimental stage with Gen AI, and smaller firms are even further behind, Alternative Legal Service Providers are leading the pack, with many of them moving from experimentation to AI adoption through contract management solutions, attendees heard. Technology vendors are also looking to add GenAI capabilities.

ADOPTION

Although interest and conversations around AI have ramped up significantly in recent years, law firms and legal departments are still lagging behind other sectors in their use of AI.

A poll taken during the webinar revealed that only 57 percent of participants currently use AI in their legal practice.

“In legal service delivery, you have to change the way that you’ve been doing things, and sometimes you have to change how you regard risk and how you leverage your teams, and how you designate work. All of that has to shift slightly, and that makes adoption hard,” said Jenny Hotchin, London, UK-based director of AI solutions at iManage.

As with any transformation, putting people at the centre of the conversation around adoption is key to buy-in, Hotchin said. Technology vendors and law firms that focus on education and upskilling people and teams will be the most successful in the technology transformation phase, she noted.

A technology transformation takes time, so collaboration between stakeholders is vital to ensure a smooth transition.

“Being in a situation where we can work really closely as a vendor with the law firm, and with the law firm’s client, and coming together and having those really frank conversations around the table is important,” said Hotchin..

iManage aims to be a trusted partner, working closely with customers to provide support as they integrate new tools. Hotchin and her team are creating a package for customers purchasing the Gen AI natural language assistant Ask iManage which will help guide them through the process of adopting this new technology.

ECONOMICS

Value created through the use of Gen AI will flow directly to law firm clients in the form of lower fees, Terrett predicts. However, he also noted that the use of Gen AI is not yet reducing billable hours, suggesting that “work expands to fill time available.”

“I think generative AI could be incredible for access to justice, and it could also be a real boon for small-to-medium sized businesses that might otherwise be locked out of legal services because of cost,” said Terrett.

Law firm clients will want to see savings in fees as AI platforms reduce time taken for legal tasks, though this will not happen overnight, in Hotchin’s opinion.

“I think expecting law firms to quickly pass on any potential cost savings through their fee structures is a little ambitious and unfair,” she noted.

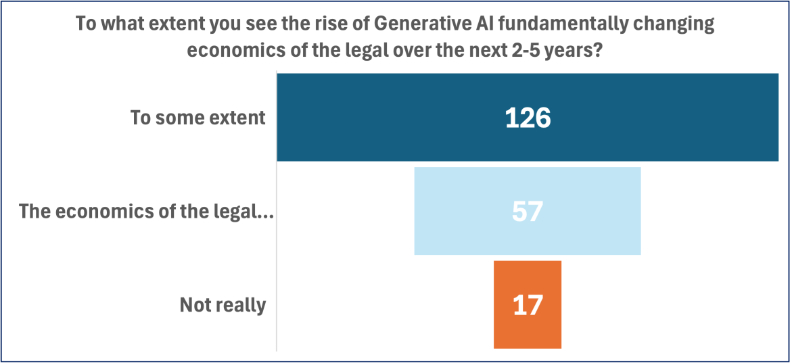

In another poll taken during the event, 29 percent of participants indicated that they believe the economics of the legal ecosystem will look completely different in the next two-to-five years, while 63 percent said it will look different to some extent, and nine percent said it will “not really” look different.

Large firms may shift to a flat fee rather than billable hours, commented Justin S. Daniels, a shareholder at Baker Donelson in Atlanta, Georgia.

“The question becomes, how do you factor in this value that you’re creating, because you know how to make the AI work in a way that gets the output that you intend? I think where you’re going to see a shift is in how this is billed, because it creates efficiency, but at the same time, new skills have to be learned to really take advantage of the promise that AI presents.”

REGULATORY RISK

Lawyers are navigating a tension between AI and security of the data, which may cause larger firms and organizations to hesitate before adopting new AI technologies – particularly in view of the complex regulatory landscape on a global scale.

Daniels advised the audience to review the National Institute of Standards and Technology’s Artificial Intelligence Risk Management Framework to better understand the regulatory environment in the US.

(The Law Society of Ontario recently published a document on Generative AI: Your Professional Obligations.)

“This technology is far outpacing the regulatory environment,” said Daniels. “In this uncertain regulatory environment, using a framework like this can help you create a program that is designed to help you comply.”

According to Terrett, the EU will play a significant role in the global regulatory landscape for AI.

“The US innovates and the EU regulates, and that’s exactly what is happening. You can’t ignore that, whether you are in the EU or not,” said Terrett.

RISK MITIGATION

Implementing AI tools is not without risk for firms and organizations. For example, they may be at risk if they fail to fully educate employees and provide the necessary materials to learn about the technology and to have an awareness of pitfalls such as the potential for hallucinations.

Consistent human intervention and engagement is also key to mitigating risk.

“What are you as an organization doing to make sure that there is a human in the loop at consistent intervals, and double checking not only the answers, but the data being uploaded?” said Daniels. He also recommended having a team of stakeholders in charge of the AI policy for the firm or organization.

USE CASES

“Looking to the future, I think there will be virtually no workflows that are not touched in some way by the application of AI,” said Hotchin. “I think this is where it is transformative. It will touch everything.” Among its many uses, Ask iManage can be used to perform short, routine tasks such as rapidly finding and listing closing procedures in a lengthy legal document, for example.

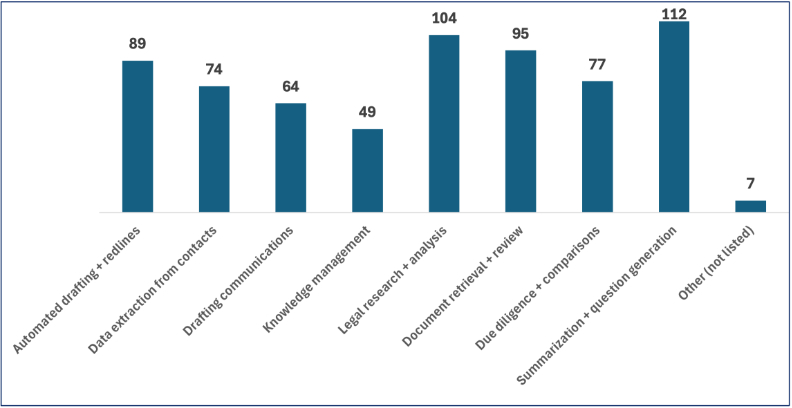

When asked in a poll ‘in which areas do you see AI as having the greatest potential impact in your legal workflow?’, attendees pointed to ‘summarization & question generation’ as the most popular use. ‘Legal research + analysis’ was the second choice, while ‘automated drafting + redlines’ came in third place.

Our speakers agreed that there are thousands of potential use cases for law firms, so testing out the technology to see where it can be useful is a good starting point.

Use cases for Gen AI to improve outputs and efficiency in the legal profession:

(Source: Andrew Terrett Consulting)

Transactions

- Contract review and drafting

- Due diligence (clause identification and extraction)

- Comparison of contracts against playbooks

Litigation

- Deposition summarization and question generation

- Document extraction for exhibits

- Written discovery responses

- Drafting communications (emails, generating timelines)

- Strategy development (brainstorming options)

General Practice

- Legal research and analysis

- Client communication

- Automated legal drafting and redlines

Operations

- Matter management

- Time tracking and billing, spend analysis

- Knowledge management

- Business development operations

Watch our webinar recording for the full conversation and demonstrations.

Stay tuned for the Legal Innovation Forum’s six-part Generative AI Masterclass series, coming in 2025.